- #Monthly family cashflow spreadsheet how to

- #Monthly family cashflow spreadsheet download

- #Monthly family cashflow spreadsheet free

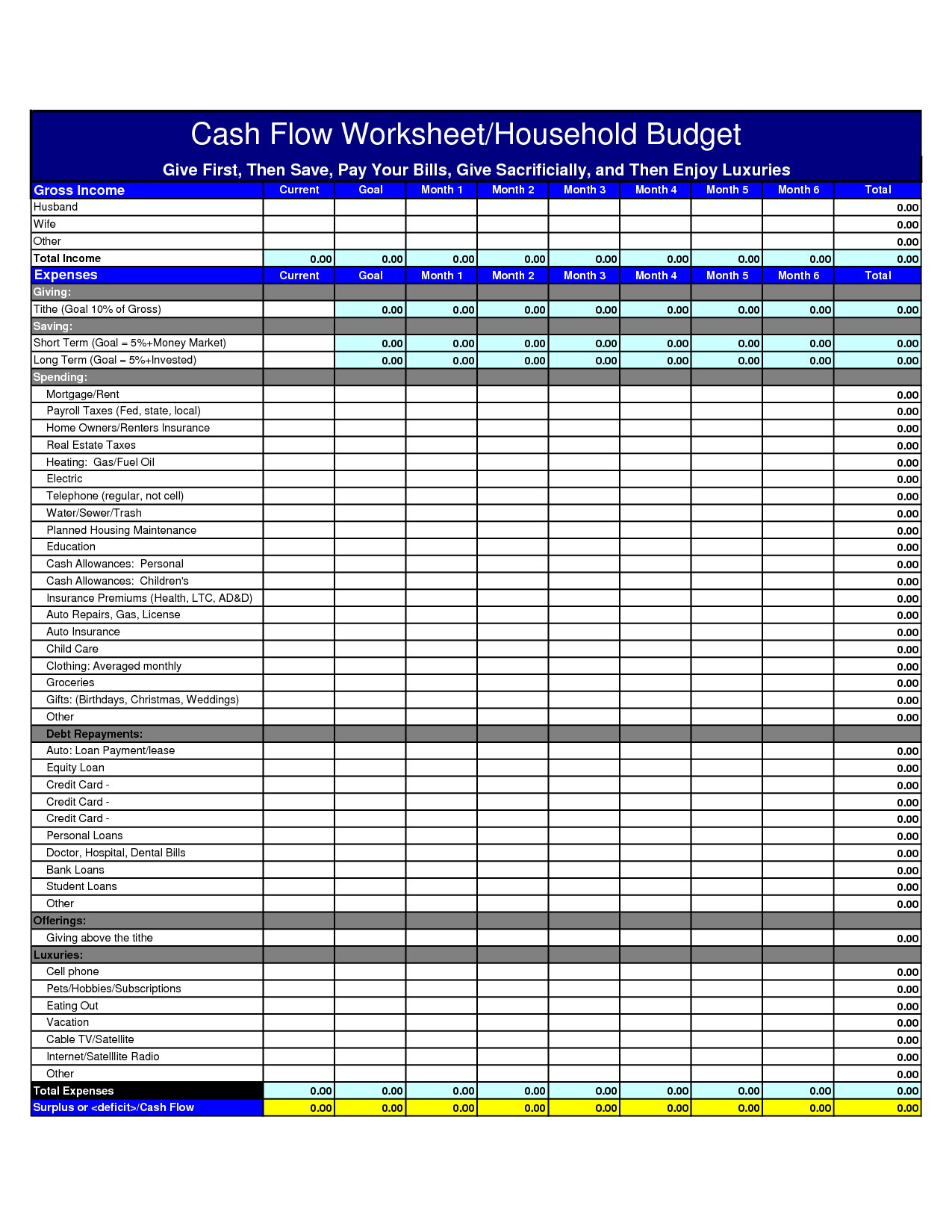

Emergency Savings – Money to cover either your living expenses if you find yourself without an income or travel expenses in case of the death or medical emergency of a close family member.The biggest reason to make a budget at this stage of your life is to make sure you are putting enough money into savings. If you have been working for several years and are able to put money in savings, you might wonder why you need to create a budget. Do I Need a Budget Spreadsheet? I’m Already Saving Some Money. Monitor your expenses to make sure that you are not overspending your budget.

#Monthly family cashflow spreadsheet how to

If your expenses and target savings exceed your income, you need to figure out how to get more income (take a second job or, in my case, take on a consulting assignment in my retirement?) or cut expenses.Īt this point in the process, you will want to identify if you can save more in your retirement accounts about distinguishing needs and wants are critically important. Run a Comparison of Income to ExpensesĬompare your expense budget to your income. Make a first pass at the expense part of your budget by looking at how much you’ve spent and whether any of your expenses are going to change. These totals tell you where you’ve been spending money and how much you’ve spent in total. Calculate Total Expenses from All SourcesĪdd up all of the expenses in (5) and (6) by type of expense. Make sure that you don’t double count the credit card payments from your checkbook with the details of the expenses from your credit card bills. Enter All Credit TransactionsĮnter all of the transactions on your credit cards into the same Excel spreadsheet, identifying the type of expense. Enter All Cash, Debit and Check Transactions into the Budget SpreadsheetĮnter all of the checks, debit card and cash transactions from your checkbook or online bank account into the Excel spreadsheet and identify the types of expenses.

#Monthly family cashflow spreadsheet free

Consider using the free Excel budget template provided in the email signup above. Begin Creating Your Excel Budgetīuild a personal budget worksheet for tracking your expenses. W-2 can result in different tax situations). Calculate Your Total Incomeįigure out how much Form W-2 or Form 1099 income you’re going to earn during your budgeting period ( 1099 vs. If you budget for a month, it is critical to remember to add expenses that you don’t pay every month as you’ll need to set aside money in short-term savings to have the money when those expenses become due. The most common time periods for a budget include a monthly or annual view.

Determine the Period Your Budget Will Cover

For many of you, your goals will include down payments on houses, refinancing student loans, college for your children and funding retirement. In my case, my primary financial goal is to make sure I enjoy my retirement. Use it to follow along with the steps outlined below to make sure you are learning how to create a budget in Excel which works for you.Īs an overview, here are the steps necessary to create a budget in Excel: 1.

#Monthly family cashflow spreadsheet download

I have a free budget spreadsheet template for you to download and use. How to Create a Budget Spreadsheet in Excel You will be less likely to run up more debt than you can afford to re-pay and will be more likely to be able to retire in the fashion you desire. However, if you make a budget, you’ll be much more confident in your financial decisions. If you don’t clean your bathroom or make a budget, you can end up with physical or financial illness that can be really hard to overcome. The longer you put it off, though, the harder it is to do. Most people don’t find creating and sticking to a budget to be a lot of fun. To be clear, the budgeting process is to your financial health what cleaning your bathroom is to your physical health. You’ll also want to include line items in your budget for the different types of savings – emergency, designated for specific large purchases and long-term/retirement. Income includes your wages and returns you get from your investments.Įxpenses include every dollar you spend, from income taxes to housing costs to food to fun stuff like vacations, sporting events and going out for a nice dinner and drinks. What is a budget? A budget is a listing of your income and the amount you can afford to spend on your expenses and put into savings.

0 kommentar(er)

0 kommentar(er)